ReFi aspires to leverage the power of DeFi and its expansive use cases, extending them to serve the greater good. Its aim is not only to democratize finance however to construct monetary constructions that contribute to society as an entire. In this text, we are going to explore the potential of ReFi, the means it compares to traditional finance, and the role DeFi plays in the future of Regenerative Finance. These solutions are the beginnings of the inspiration for the choice monetary system that underpins ReFi’s existence. And while regenerative finance not always fully regenerative in scope, ReFi solutions are certain collectively by the need for elementary change.

Regeneration Grows Useful Resource Capacity Over The Lengthy Term

“Our objective in introducing this model is to encourage the journey and tourism sector to adopt sustainable practices that profit each the surroundings and human population,” he mentioned. The launch of the model follows the G20 tourism ministers working group meet in June 2023, that got here up with the Goa highway map for tourism as a way for achieving the sustainable improvement targets. EY’s climate change and sustainability practices have over 1,four hundred advisors across the globe.

A Monetary System Rising From The Web3 Motion

Ecology conservation, upliftment of marginalised communities, income for all, and so forth. Ambiguity around what a ReFi tasks seeks to realize results in confusion and frustration among the many individuals. ReFi helps green initiatives that focus on each ecological and economic sustainability. Users can buy impression tokens or acquire them free of charge by way of airdrops so that they’ll participate in a blockchain’s decision-making around investing in or supporting regenerative initiatives. Tokenised green bonds are issued to fund tasks of ecological significance such as alternative energy.

Constructing On The Shoulders Of Giants: A Short Stroll By Way Of Historical Past

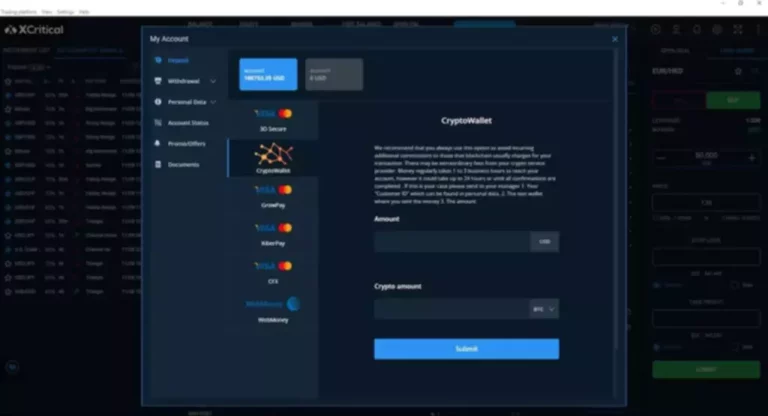

ReFi makes use of blockchain know-how and deploys Web 3.0 services such as good contracts, crypto wallets, green DAOs, impact tokens and so forth. to pursue its aim of sustaianable progress. • In a standard financial system, goods are consumed and thrown away instantly, leading to unfavorable environmental impact. In a regenerative economy, goods are used, repaired, reused and recycled, with minimal injury to the surroundings. Another objective of ReFi is inclusive growth as a substitute of the growth of merely a quantity of rich people.

Principles Of Regenerative Vitality

- Tokenised green bonds are issued to fund initiatives of ecological significance corresponding to alternative power.

- Transitioning to this model of funding also opens the door to much more inclusive financial techniques, the place people of all demographics can turn into energetic individuals quite than merely passive observers.

- Regenerative agriculture has been a model example of regenerative finance in motion.

- However, ReFi fosters transparency and decentralisation, empowering people and promoting broad monetary participation.

- This way, all of the impacted stakeholders have a say in every choice being taken.

In other words, taking the Web3 solutions available to it—blockchain, cryptocurrency, sensible contracts, and decentralised autonomous organisations (DAOs)—and using them to build monetary and tech options that enable optimistic real-world impression. In its most basic type, ReFi represents a belief that our current financial and financial system needs to fundamentally change if we are going to address the systemic issues we face. This new system needs to be decentralised, equitable, and regenerative, as opposed to centralised, unjust, and extractive. In the financial business, environmental points (Environment), social aspects (Social), and accountable corporate governance (Governance) have played a central function for a quantity of years.

What Are The Necessary Thing Traits Of Refi Systems?

Everyone can leverage ReFi’s digital infrastructure to coordinate and pool sources throughout borders, design merchandise that serve key needs for local communities, or construct providers that accelerate climate action. Decentralized exchanges (DEXes) let customers commerce cryptocurrencies without the necessity for intermediaries. Instead of matching purchase and sell orders, often DEXes enable exchanges with “liquidity pools”. Users deposit funds into a pool (these users are called Liquidity Providers or LPs), and everyone can freely trade their funds with what’s in the pool.

The blockchain expertise has disrupted the finance sector by offering a decentralised model, resulting in a surge of cryptocurrencies and different Web three.0 ventures over the earlier couple of years. It has been a studying course of building banking infrastructure and monitoring systems that can be nimble and conscious of project needs and timelines. “We’ve been studying concerning the totally different infrastructure elements we need from aligned banking establishments that process transactions in a method that will permit us to service loans on time,” says coauthor Lauren Ressler, who helps administer the loan fund.

The rise of technology and growing consciousness of sustainability is driving the growth of regenerative finance. It provides a promising solution for aligning financial objectives with values and making a future that is each affluent and sustainable for all. Looking for tactics to align your investments along with your values and create a positive influence on the environment?

EY and IIGCC collaborated on this text for example how traders can play a key position in preventing biodiversity loss. Discover how EY insights and companies are helping to reframe the means ahead for your business. Grow Indigo is leading the transformative movement in path of regenerative agriculture in India, seamlessly blending the experience of Mahyco and Indigo Ag. We believe there are causes to feel hopeful – It all depends on how we choose to contextualize.

It perpetuates a cycle of exploitation, undermining the vitality of our communities and the pure world. Are you curious about learning extra about regenerative finance and the way your group or enterprise can profit from and apply it? The societal techniques we’ve collectively developed in the industrial age cannot be fastened using easy solutions. It is all linked to our trendy civilization having its very basis constructed upon a monetary system that takes more than may be replenished. The surge in ReFi’s populairty underlines a powerful recognition of a necessity for a sustainable economic coverage for the means ahead for humanity. As entrepreneurs, governments, economists and concerned citizenry come together, it’s anticipated that the adoption of ReFi will progress and its ideas will guide financial policies sooner or later.

A combination of finance, sustainability, regeneration, and social responsibility, regenerative finance (ReFi) seeks to attain financial and social benefits for everybody as it imitates the regenerative model of nature. Instead of only considering your financial capability to repay the loan, your participation in neighborhood initiatives or environmental initiatives can be taken into consideration. If you contribute positively to your community and the environment, you’ll obtain extra favorable mortgage terms — turning your mortgage into a device for social progress. Regenerative Finance (ReFi) is an approach to economic systems that places the health of our ecosystem and social equity at its core.

Universal primary revenue, or UBI, is a system where everyone appears to be given a set amount of money on an everyday basis. It’s conditionless and out there to anyone, regardless of their background, schooling, nationality, or income. UBI can operate as a safety web for folks, and it is supposed to guarantee that everyone has a primary lifestyle and can cover basic wants. Projects like Proof of Humanity, Circles and GoodDollar provide an unconditional UBI cost to all members trusted by other members of their respective communities. Digital technologies, and particularly Web3 instruments, present plenty of promise to assist provide UBI to folks around the globe.

Read more about https://www.xcritical.in/ here.

Leave A Comment